Solving PCI Compliance for Good

Accelerate PCI Compliance Without Storing Sensitive Data

Whether you’re launching a new business that requires PCI certification or managing your own PCI Card Data Environment (CDE), VGS can help. The VGS Zero Data® Platform allows you to operate on sensitive payment data without ever touching it, achieving PCI compliance in as little as one week and helping you scale faster.

Try it for freeBook a Demo

Get to Market Faster

PCI Solutions

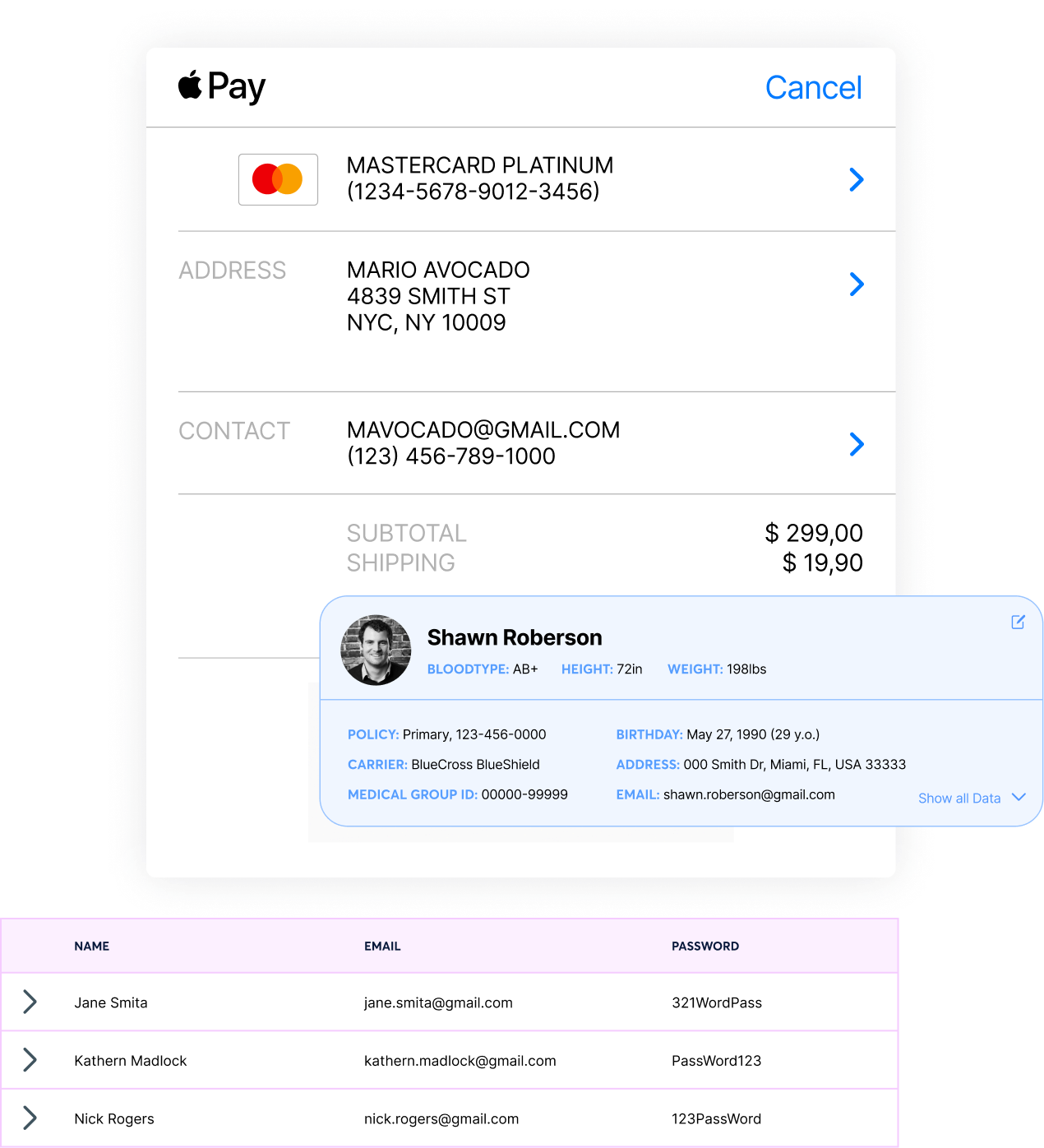

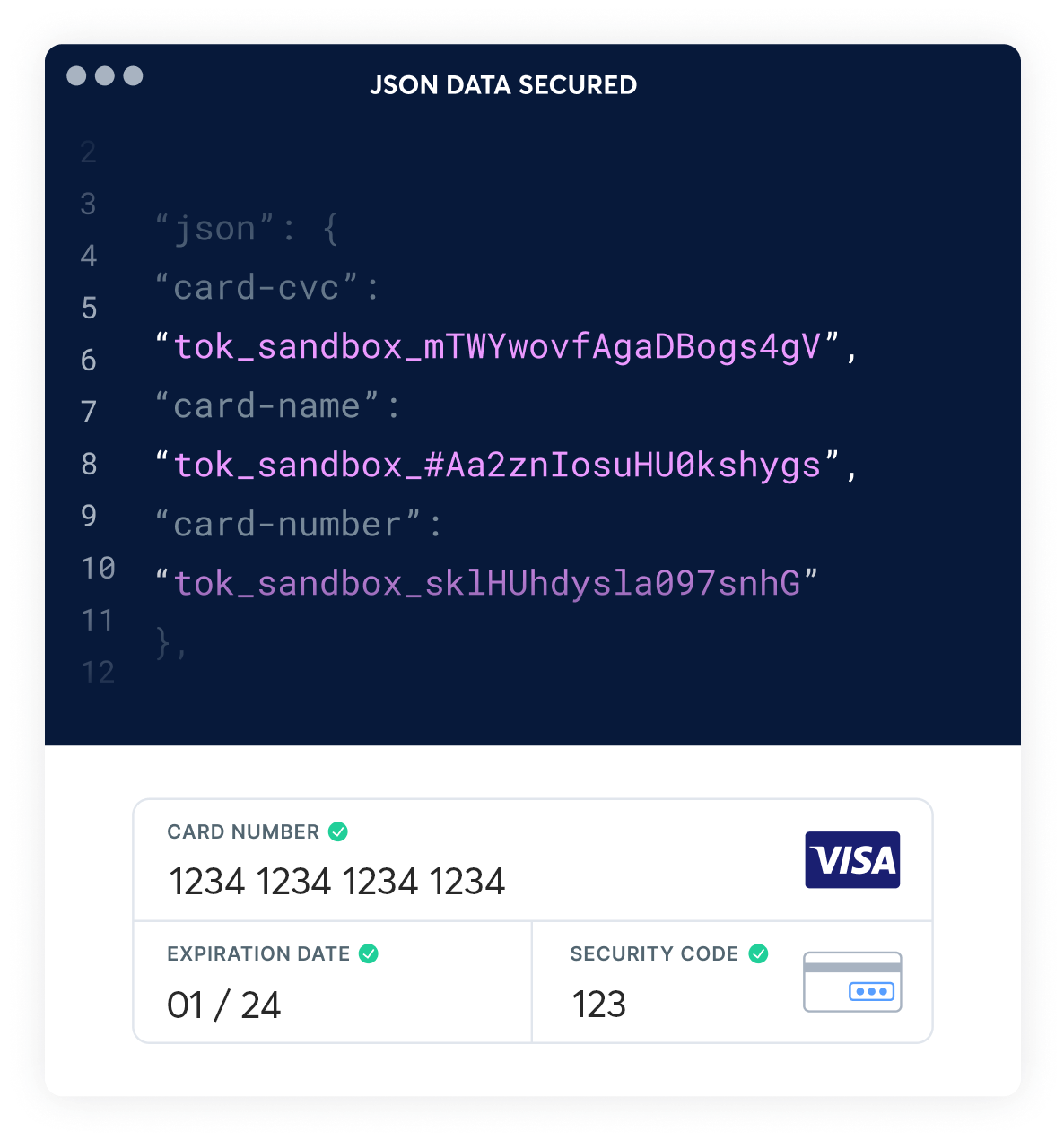

VGS fundamentally solves PCI compliance differently than other vendors. Where others offer point solutions, our VGS Zero Data® Platform you to work with a broad array of payment data, without touching it. With VGS, you can collect, store, and send payment data to any of your third-party endpoints safely by swapping out raw sensitive information with our secure data aliases.

- Continuous PCI DSS Compliance

- Offload Liability, Risk & Burden

- Military-Grade Security

- Retain Data Ownership & Portability

- Flexibility to Add PII, PHI or Credentials

Descope PCI Data

How it Works

As the leading PCI Solution Provider, our platform enables companies to seamlessly operate on sensitive payment data without ever touching it.

The VGS Zero Data Platform shields you from sensitive data by substituting sensitive, raw payment data in real time, replacing it with non-relational aliases (a form of synthetic data) in place of original values. VGS operates at the network level, so your systems never come into contact with sensitive data. You stay completely protected without any architecture changes or the need to integrate a separate API; freeing your organization to focus on growing your business rather than the liability of protecting it.

Go to guidesGet Continuous PCI Compliance Service

Maintain continuous PCI compliance with VGS’s dedicated full-time resources building a secure network, protecting cardholder data, enforcing information security policies, and more

Reduce Costs by 50-75%

Instead of wasting resources pursuing PCI from scratch, offload your data security to VGS and save up to 75% on compliance costs

Maximize Data Value

Extract maximum value from your data with full format preservation and avoid vendor lock-in with complete ownership, portability, and utility of your data

Get PCI Level 1 certified in as little as 21 days

With VGS

Achieving PCI Level 1 on your own often takes 6-12 months, or longer, on top of recurring annual PCI security maintenance and audits. Reaching Level 1 requires dedicated full-time resources to build and maintain a secure network, protect cardholder data, uphold a vulnerability management program, implement strong access control, monitor and test networks, and enforce an information security policy.

Without VGS

PCI Level 1 is achievable in just 21 days, no matter the type of business (merchant, service provider, or other). Integrate to VGS with no changes to existing systems, and instantly begin securing, managing and using sensitive data.

By using VGS for data security and PCI compliance rather than building a solution from scratch, TCB was also able to launch their commercial card 6-9 months faster.

Read Case Study