VGS Card Account Lifecycle Management (CALM)

Drive higher card approval rates, enhanced security, and improved customer experience

VGS Card Account Lifecycle Management (CALM) provides a complete card account updating service for your card-on-file data ecosystem. Part of the VGS Payment Optimization suite, VGS CALM maximizes the coverage and capabilities of any card-on-file environment with direct-to-network features to reduce costs while increasing transaction throughput.

Request a Demo

VGS CALM Offers Card Account Updater and Network Token Management provides centralized control and cost-effective coverage across any payments ecosystem

Card Account Updater

Push and Pull Updates Keep Your Card Credentials Fresh.

As a subscription-based merchant, stale card information can be a real customer attrition problem for you. You can avoid the need to ask your customers to update their payment information. According to Charge Back Gurus, “many customers seem to regard a declined subscription payment as a sign from the universe that it’s time to let that subscription lapse, anyway—the success rate for updating a card after its first decline is about 5%.” For example, Americans who pay for their monthly gym membership subscription without actually going to the gym, so once there is a declined transaction due to stale card information, many members just end up attritting. According to a Mastercard case study, Netflix was able to reduce customer attribution by 30% with an account updater service.

With VGS CALM, you will be able to manage the largest pool of card accounts available in the marketplace to see a reduction in false positive declines caused by outdated card information. By reducing false positives over the course of time, you will see a natural increase in customer retention and revenue by up to 3%+.

Network Token Management

(Coming Soon)

Heightened Security. Greater Throughput. Lower Costs.

Card Networks offer merchants merchant-specific network tokens that replace a 16-digit PAN with a unique 16-digit identifier called a Network Token (NT). The NT allows the payment to be processed without exposing sensitive card information. Unlike tokens provisioned by other payment service providers (PSPs), which can only be processed by the provisioning PSP, VGS NTs are interoperable between PSPs and are recognized by the card network and card issuers.

In addition to providing security and cost-reduction, NTs are updated in near real-time whenever there is a change in the underlying card account. For example, if the underlying card account has been replaced due to card expiration or lost/stolen reasons, the underlying account associated with the NT gets updated automatically. VGS NT requires no action by the merchant, thereby providing a seamless, uninterrupted experience.

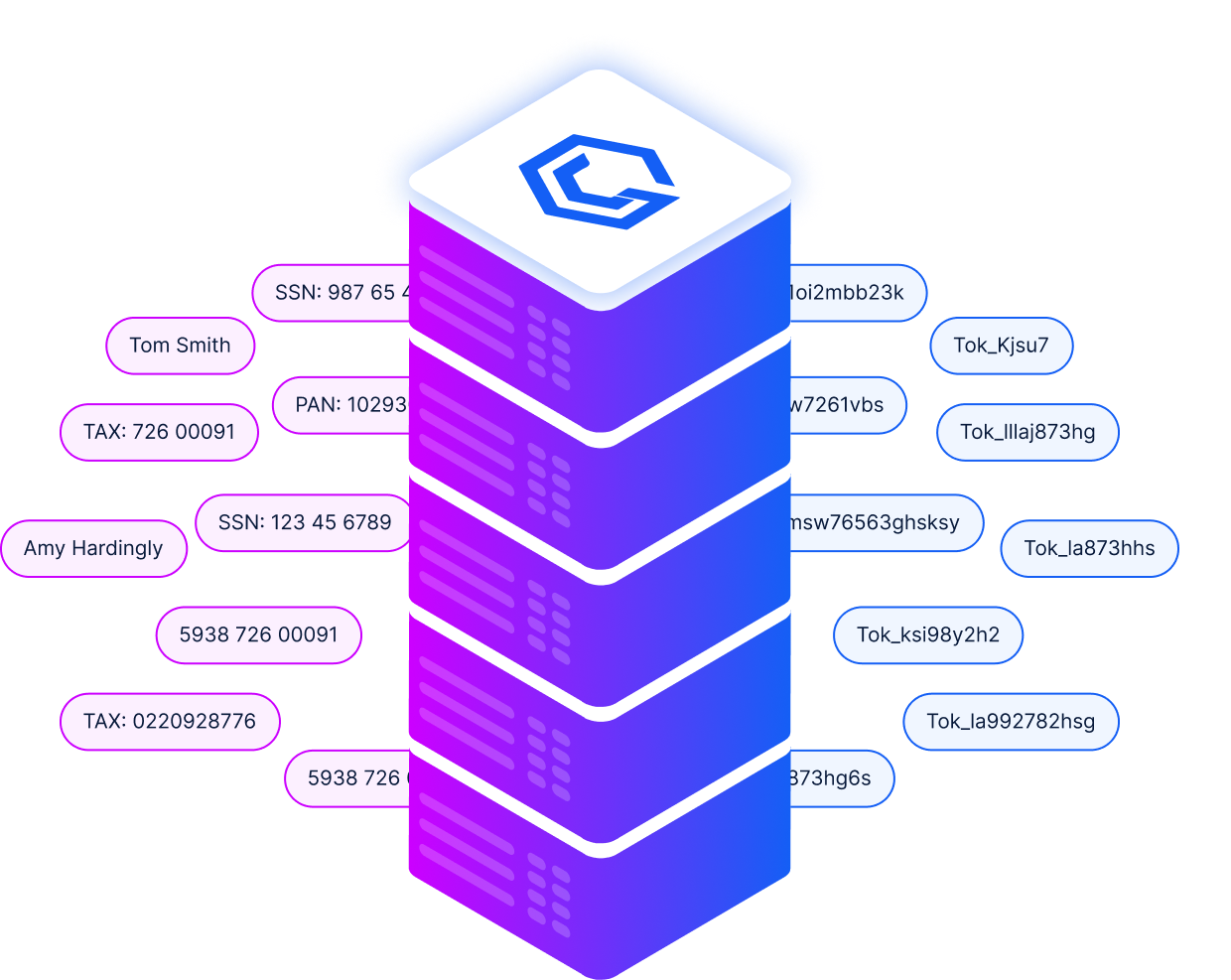

VGS CALM consolidates Network Token and Account Updater

Providing centralized control and cost-effective coverage across any payments ecosystem

With VGS’ CALM service, you will be able to update the largest pool of card accounts available in the marketplace. As a result of CALM, you will be able to see a reduction in false positive declines due to outdated card information. With the reduction in false positives over the course of time, you will see a natural increase in revenue of 1% to 3%+.

With many subscription-based merchants, stale card information can be a real customer attrition problem for them. It is in the best interest of any merchant, especially subscription-based merchants, to avoid the need to ask their customers to update the payment information. According to Charge Back Gurus, “many customers seem to regard a declined subscription payment as a sign from the universe that it’s time to let that subscription lapse, anyway—the success rate for updating a card after its first decline is about 5%.” For example, Americans who pay for their monthly gym membership subscription without actually going to the gym, so once there is a declined transaction due to stale card information, many members just end up attritting. According to a Mastercard case study, Netflix was able to reduce customer attribution by 30% with an account updater service.

VGS CALM for merchants builds on the benefits of Network Tokens and Account Updating Services by providing a seamless and secure consumer experience.